Chip manufacturer Nvidia has become the first company in history to hit a $4 trillion dollar market capitalisation on Wall Street, after a rapid rise in value over recent months (per the Financial Times). The Silicon Valley firm’s share price rose 2.8% on Wednesday to $164.36, taking it past the previous record valuation held by Apple of $3.92T in December 2024.

The chip maker has bet big on the so-called AI revolution, and manufactures the vast majority of the chips powering the field’s major companies like OpenAI. It also recently signed a bunch of multibillion deals in the Middle East, and has been a beneficiary of President Donald Trump rowing back on his threats of a trade war with China. The Financial Times describes Nvidia as “the biggest beneficiary of a tech boom that has exceeded the headiest days of the dotcom era,” which might give some of us a little pause.

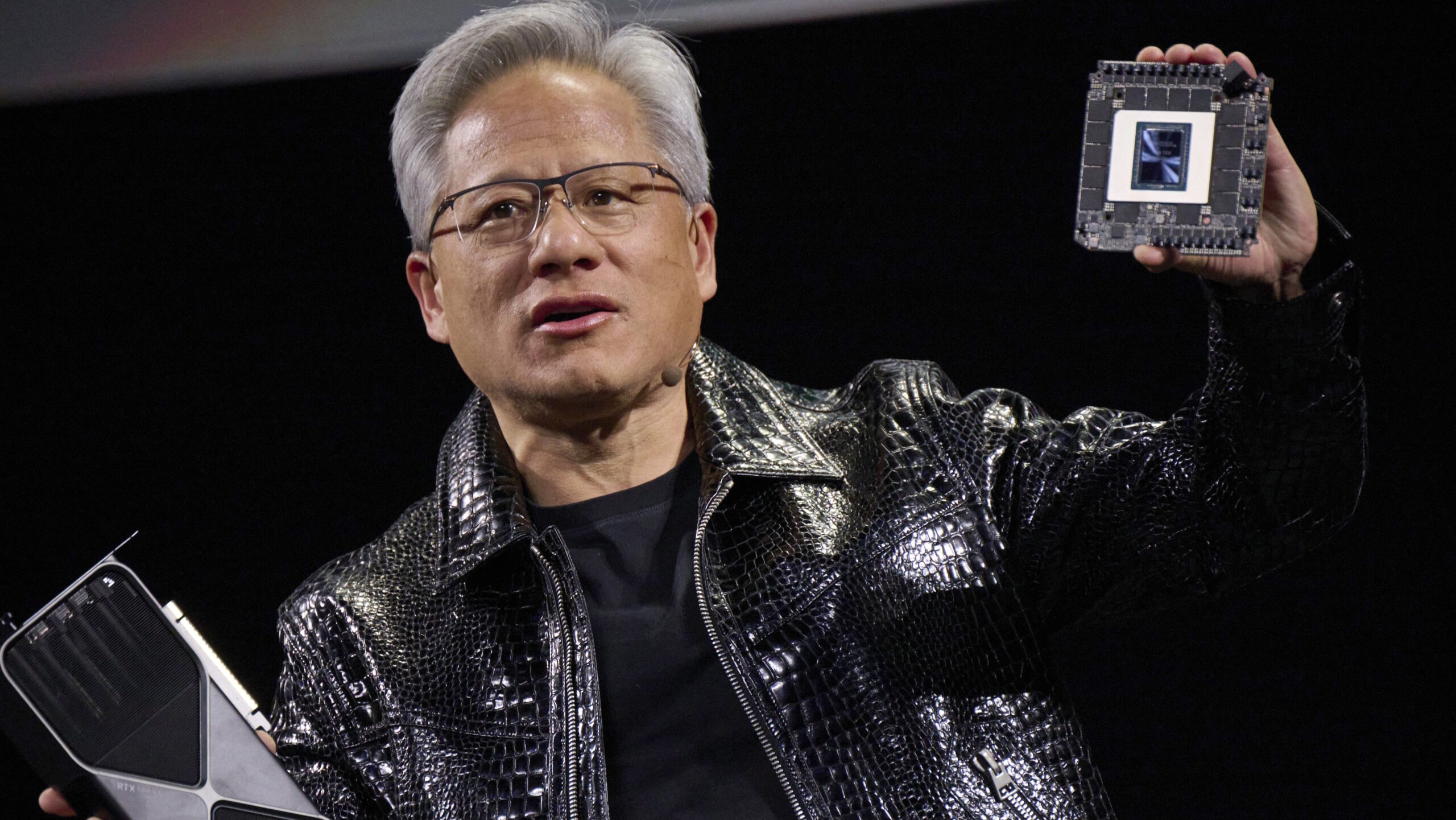

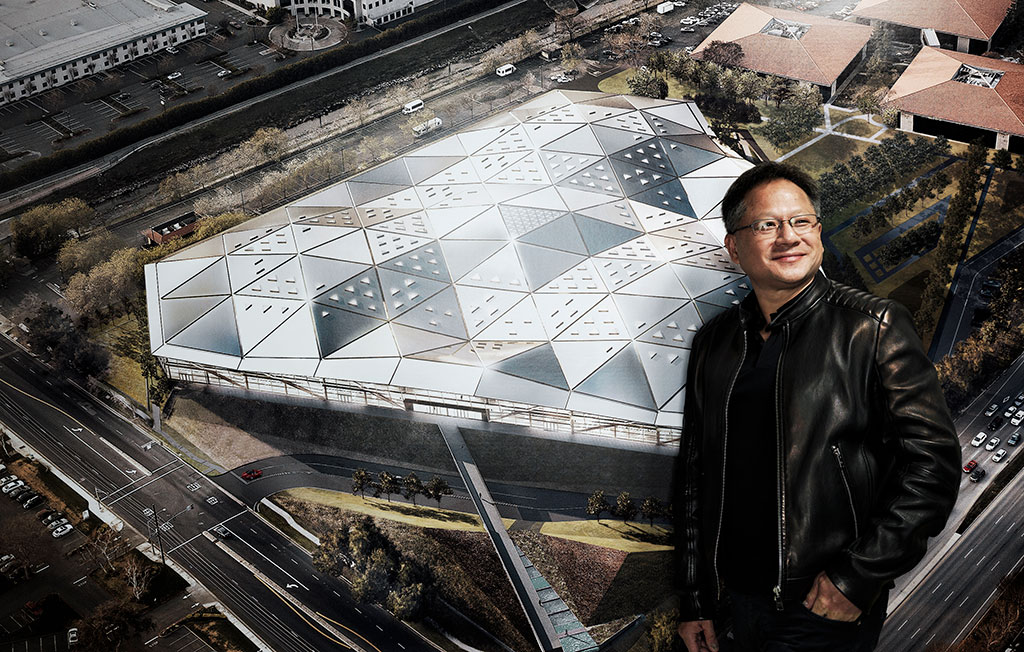

CEO Jensen Huang has led the company’s push into AI and associated technologies like robotics, and has spearheaded enormous investment in infrastructure like data centres that should keep Nvidia ahead of any rivals for years to come. In May the company reported a 70% increase in quarterly revenues and Huang bragged that various factors meant demand for its AI chips was “kicking into turbocharge.”

Turbocharge is certainly one way to describe this current valuation: Nvidia was worth around $1T only two years ago. What changed? This was around the time that technologies like ChatGPT began to become available to the public, and tech firms began jamming AI into as many products as possible: It’s nigh-on impossible to use the mainstream internet now, nevermind your own PC, without rubbing up against AI features constantly.

And you know who loves AI, right? “The more AI, the better [the] bottom line,” said Huang last month. “The absence of AI is the only thing I worry about.”

The company’s shares have been mostly on the climb ever since. Nvidia’s valuation hit $2T in February 2024, then $3T in June 2024, before briefly sputtering in early 2025. This was driven by a combination of concern about whether the demand for its chips would keep growing, and the wider context of President Trump’s threat to impose global tariffs, and in particular what would happen with China.

Nvidia still faces restrictions on selling its most powerful chips to China, but the company has been openly lobbying against it, with dire warnings that this will only strengthen China’s homegrown industry. But clearly shareholders think that, even with the uncertainty over China, there’s enough global demand for Nvidia chips to keep the momentum going.

Analysts S&P Capital IQ project that Nvidia’s revenue will come in at just under $200B this year, which would be up 55% year-on-year, with net income of $105B.

Good times for some, anyway: Nvidia’s leadership including Huang sold $1B worth of shares in late June. Nvidia said at the time that Huang’s sales were part of a pre-arranged plan, and he retains the vast majority of his shares in Nvidia. Huang can sell up to six million shares before the end of 2025, which at the firm’s current valuation would be worth just under a billion dollars. Not that he needs it: Forbes estimates Huang’s net worth at $138B, making him the 11th richest person in the world.