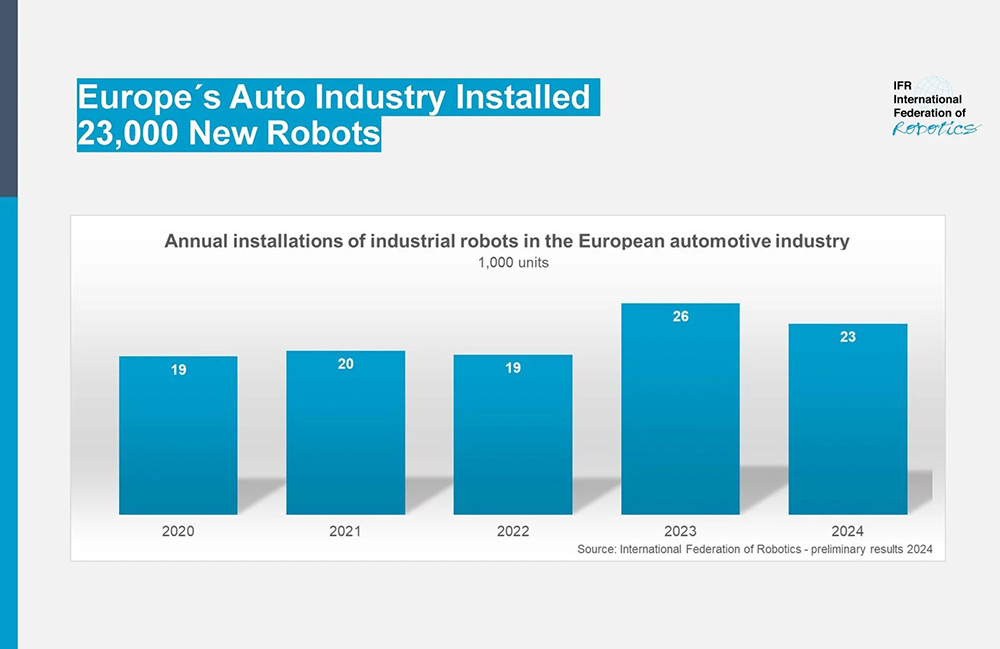

Investments in automation for the car industry in Europe remain high, according to the International Federation of Robotics, or IFR. The total number of industrial robots installed reached 23,000 in 2024, which is the second-best result in five years, said the organization today.

“The European automotive sector is the region’s strongest customer industry for robotics,” said Takayuki Ito, president of the IFR. “Car makers are accounting for around a third of annual manufacturing installations in Europe. In terms of automation activity, the combined number of 23,000 European robot installations in the car sector was ahead of the 19,200 units installed in North America in 2024.”

Last month, the IFR reported that U.S. automakers have also been investing more in automation. It said total installations of industrial robots in the automotive industry increased by 10.7%, reaching 13,700 units in 2024.

However, while the U.S. is installing more robots, it isn’t producing most of them. The majority of these robots come from overseas. Globally, 70% of installations are produced by four countries: Japan, China, Germany, and South Korea, the IFR said.

Switzerland leads the way in Europe robot density

At a global level, Europe’s car manufacturing is highly automated, the IFR said. Six countries on the continent were among the top 10 in the world’s robot density ranking for the automotive industry in 2023. Switzerland was in first place, with a ratio of 3,876 robots to 10,000 factory workers.

Slovenia was in third place with 1,762 units, Germany was in sixth at 1,492 units, and Austria was eighth with 1,412 units. Finland came in ninth with 1,288 units, and the Benelux countries were in tenth place with 1,132 units.

Aside from Switzerland, all of these automation champions were EU member states. The EU27 countries’ leading role is evident not only in the automotive industry, but across all sectors, accounting for around 85% of all regional installations in 2024. said the IFR.

Germany, which is among the top five robot markets in the world, had a share of about 30% of the total installations in Europe. Italy followed with about 10%, and Spain with about 6%. From 2019 to 2024, the compound annual growth rate (CAGR) of robots installed in Europe was +3%.

China sees strong demand for automation in automotives

China’s national robotics strategy has led its manufacturing industry to install a total of about 280,000 units per year between 2021 and 2023. In 10 years, the country‘s global share of industrial robot installations has risen from around one-fifth to more than half of the world’s total demand, the IFR said.

In addition, robotics and automation are penetrating all levels of Chinese production. For example, the country has a high robot density of 470 robots per 10,000 employees in manufacturing, the third highest in the world, surpassing Germany and Japan in 2023.

China isn’t slowing down anytime soon. In March 2025, its government announced plans to invest nearly $137 billion in robotics, AI, and innovation over the next 20 years, according to the IFR. This initiative aims to continue China’s technology-driven success in manufacturing.

Now accepting session submissions!

The post Robot sales for the automotive industry remain high in Europe appeared first on The Robot Report.