Since peaking in 2021, drone industry funding has plummeted. And yes, that comes with plenty of bad news. Just don’t panic yet. There’s good news too, and drone companies are finding ways to thrive without the venture capital fire hose.

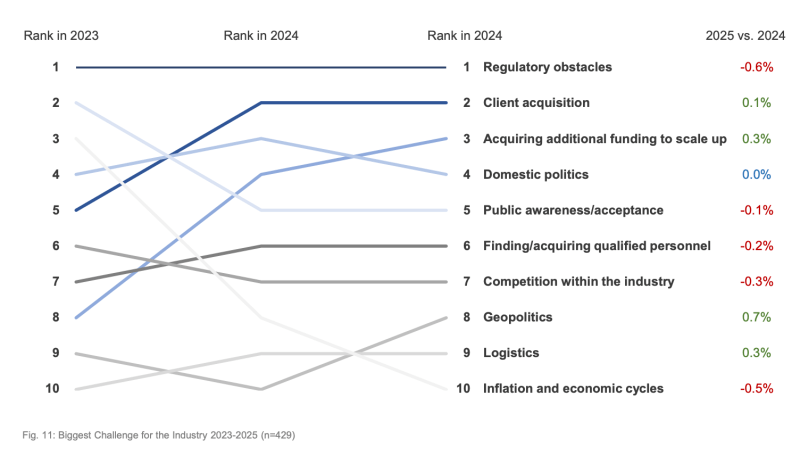

Let’s start with the bad news. Not only is drone industry funding sharply down from its 2021 peak, but drone companies are feeling the hit. A Drone Industry Insights survey of nearly 800 people in the drone industry, conducted in mid-2025, asked what the biggest challenges facing the industry in 2025 were.

“Acquiring industry funding” was the third biggest challenge. That’s especially notable considering it only ranked eighth in 2023 as the biggest challenge.

In 2025, the only two things that ranked higher were regulatory obstacles and client acquisition. That’s all according to DII’s Global State of Drones 2025 report.

Drone industry funding in 2024 hit lows not seen since 2018, and 2025 drone industry funding is shaping up to not fare much better. More staggering is the drop-off.

To understand the magnitude of the shift, consider this: From 2019 to 2020, and again from 2020 to 2021, investment in drone companies doubled each year. Drone industry investments peaked in 2021 at $3.67 billion.

But the party came to an abrupt end in 2022, when both total funding value and number of deals involving drone companies decreased for the first time. By 2024, investments in drone companies fell to just $820 million.

The Drone Industry Insights survey identifies 2021 as marking “the peak of drone market investments,” and notes that “despite a strong decline in funding since then, the overall development remains relatively robust.”

That last part phrase — “relatively robust” — deserves attention. Because while the money has dried up, the industry hasn’t collapsed. Companies are surviving, and some are even thriving. How?

Consider interest rates

Understanding the funding freeze requires understanding the broader economic context. The survey report notes that “a period of high interest rates began in July 2022. This heralded a venture capital crisis among drone companies, resulting in a period of intense market consolidation that continues to this day.”

And what we have now? The actual market for drone services and products is growing — it’s the speculative investment that’s contracted. When interest rates were near zero, investors could afford to bet on long-shot moonshots. When rates rose, they demanded quicker paths to profitability. What we have today are companies like DroneDeploy, which announced it had reached break-even in September 2025.

How drone companies are shifting resource allocation

DII’s September 2025 survey asked companies about their top priorities for resource allocation. Marketing and sales continues to consume about a third of resources (29% in 2025, down slightly from 31% in 2024), but funding has become a much higher priority.

What’s particularly telling is how different types of companies prioritize funding. According to the survey data, drone service providers (DSPs) put the highest priority on funding at 20%, while component manufacturers show the lowest need at just 9%.

Presumably, component manufacturers have simpler business models with clearer paths to revenue. Service providers, meanwhile, need capital to scale operations across multiple locations and acquire equipment before they can generate returns.

The silver lining for the drone industry

While the drone funding freeze is painful, it’s forcing the industry toward sustainability. Companies that survive this period will have proven business models, actual customers and realistic unit economics. The hype-driven “fake it till you make it” era is over.

DII’s survey’s findings support this interpretation. Despite the funding challenges, expectations for market growth remain positive. The industry’s overall development score increased slightly from 6.1 to 6.8, and expectations for the next 12 months rose from 6.8 to 6.8.

Different segments are experiencing this differently. Drone software providers are “the big winner,” with their development score increasing to 7.2 and expectations for the next 12 months reaching 8.0. Meanwhile, drone integration and engineering companies—which often require significant upfront capital—experienced the sharpest decline.

What’s next for the industry amidst lighter drone funding

So how are drone companies actually surviving without venture capital fire hoses? The survey and broader industry trends point to several strategies:

Focus on cash flow: Companies are prioritizing paying customers over user growth. Revenue today beats the promise of revenue tomorrow.

Strategic partnerships: Rather than trying to do everything in-house, companies are partnering with established players who have distribution channels and customer relationships.

Lean operations: The days of lavish office spaces and rapid hiring are over. Companies are staying small and focused.

Geographic expansion: Rather than raising money to scale nationally, companies are proving the model in one region and then carefully expanding.

Specialized applications: Instead of trying to be everything to everyone, successful companies are going deep in specific niches where they can command premium pricing.

I also predict that this drone funding ‘freeze’ isn’t temporary, but rather a reset to more sustainable norms.

For entrepreneurs entering the drone space, this doesn’t have to be devastating news. Yes, getting funded is harder. But that means less competition from well-funded competitors with unsustainable business models. The companies that win will be those that solve real problems for customers willing to pay, not those that raised the most money.

The Great Drone Funding Freeze is painful, but it’s also purifying. The industry that emerges will be built on revenue, not runway. And that’s how sustainable industries are built.

The post The great drone funding freeze: How the drone industry can survive without VC cash appeared first on The Drone Girl.